Calculate self employment tax deduction

You can claim 50 of what you pay in self-employment tax as an income tax deduction. The self-employment tax is 153 which is 124 for Social Security and 29 for Medicare.

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

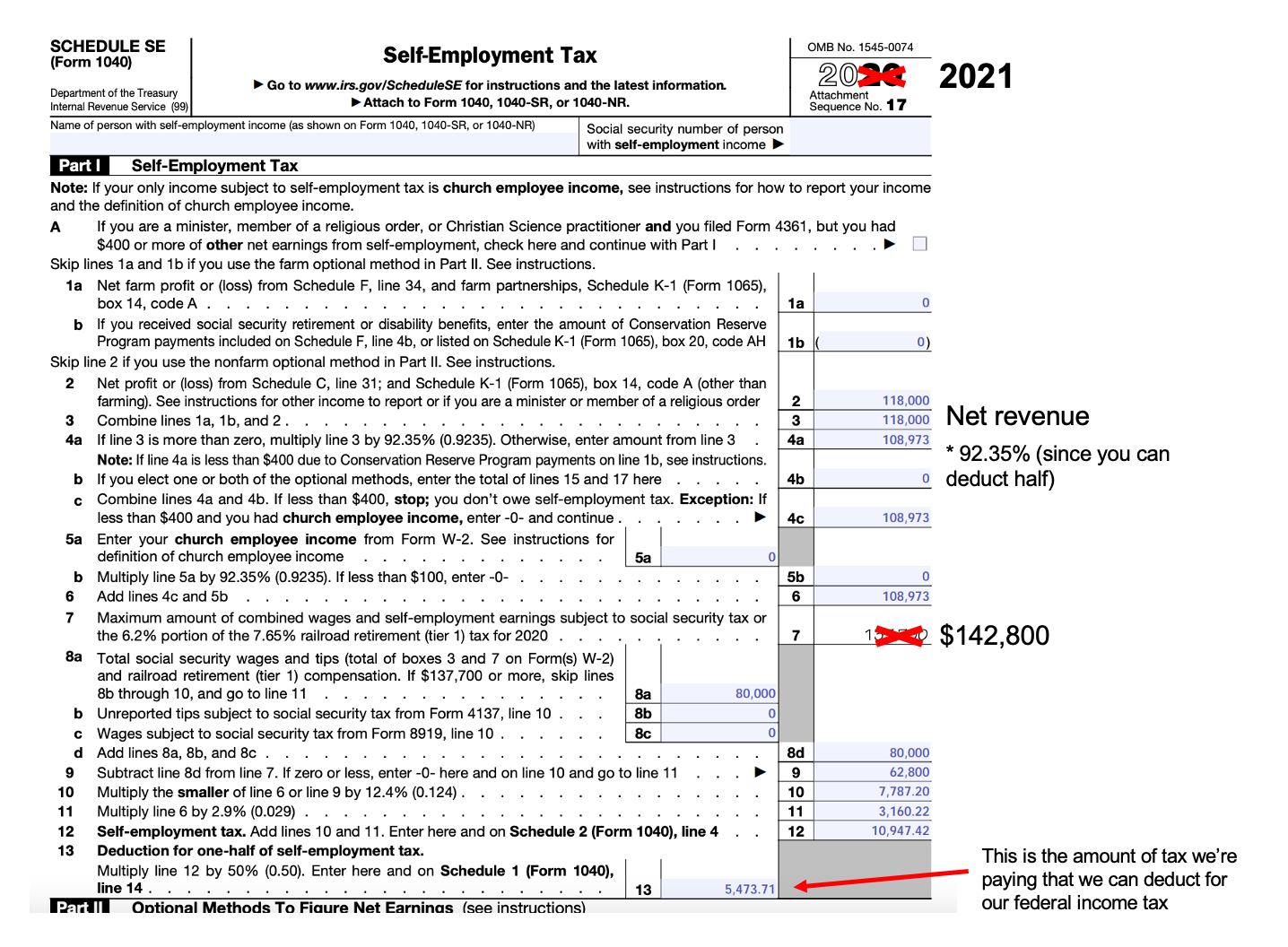

Compute self-employment tax on Schedule SE Form 1040.

. How much self-employment tax will I pay. Self-Employment Tax to calculate how much self-employment tax you should have paid throughout the year. In this way the IRS differentiates the SE tax from the income tax.

See 50 Limit in chapter 2 for more information. Temporary 100 deduction of the full meal portion of a per diem rate or allowance. As a self-employed person you pay the full share of your Social Security and Medicare taxes.

Step one when looking to reduce self employment taxes is taking all above the line deductions. Business Use of Your Home Including Use by Day-Care Providers. The other main federal payroll tax is for Medicare.

Actual results will vary based on your tax situation. Follow the steps below to get an idea of what you owe. Thats right the IRS considers the employer portion of the self-employment tax 765 as a deductible expense.

If you file a joint return with another self. You are responsible for federal and state if applicable taxes on your adjusted gross incomeSo the more tax deductions you can find the more money youll keep in your pocket. In the real world the critical issue for the tax authorities is not whether a person is engaged in a business activity called.

Reporting Self-Employment Tax. As a self-employed individual you are generally responsible for estimated quarterly tax payments and an annual return. When in doubt always consult a tax professional or accountant.

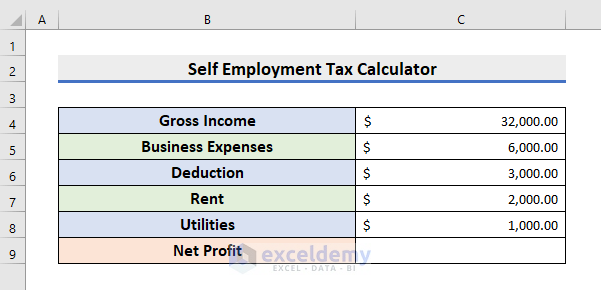

Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax. Because of this you are eligible for a credit from the IRS if you. To begin calculate your net earnings for.

Each individual will calculate Additional Medicare Tax on half of the total self-employment income earned by both RDPs. A document published by the Internal Revenue Service IRS that provides information on how taxpayers who use. Self employment deduction - the easy one already included in your estimate above.

Multiply that number by the current self-employment tax rate. As of Jan. That rate is the sum of a 124 Social Security tax and a 29 Medicare.

In general the wording self-employment tax only refers. For amounts incurred or paid after 2017 the 50 limit on deductions for food or beverage expenses also applies to food or beverage expenses excludable from employee income. Who Must Pay Self-Employment Tax.

This deduction is taken into account in calculating net earnings from self-employment. Instead you must report your self-employment income on Schedule C Form 1040 to report income or loss from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit. Youll figure your self-employment tax on Schedule SE.

If that number is higher than 0 multiply it by 9235 the amount of your self-employment income that is subject to the self-employment tax. One available deduction is half of the Social Security and Medicare taxes. How much of my social security benefit may be taxed.

The self-employment tax rate is 153 of net earnings. You calculate your self-employment tax on Schedule SE and report that amount in the Other Taxes section of Form 1040. Steps to Calculate Self-Employment Tax.

The Internal Revenue Service requires anyone making 400 or more in self-employment income to file a tax return. Below is a non-comprehensive list of the most important deductions to should consider. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return needs to be filed. Compare taxable tax-deferred and tax-free investment growth. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.

Knowing how to calculate self-employment tax is a beneficial skill that better prepares you when its time to file taxes. Expenses for Business Use of Your Home and then enter the result here. The return must include a Schedule SE which you use to calculate how much self-employment tax you owe.

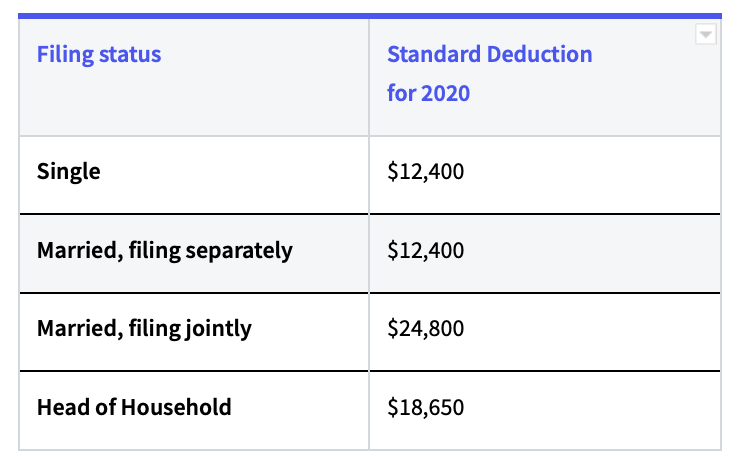

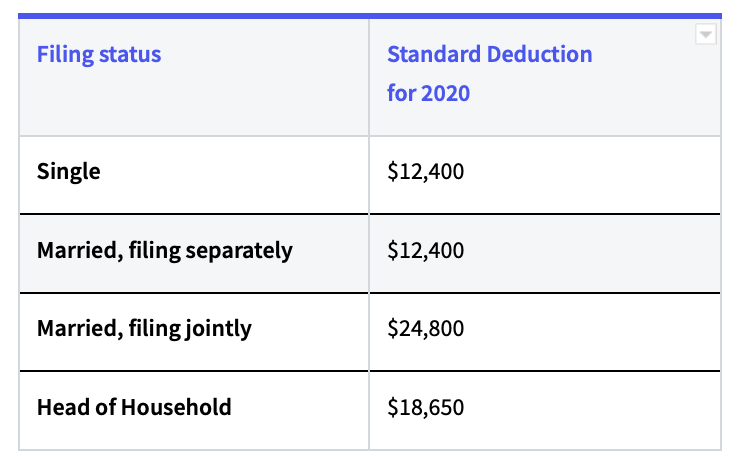

Should I itemize or take the standard deduction. See below to learn how to calculate this tax. See the Form 1040 or 1040-SR and Schedule SE instructions for calculating and claiming the deduction.

What are the tax implications of paying interest. However if youre self-employed you have to pay both portions of this tax. When figuring your adjusted gross income on Form 1040 or Form 1040-SR you can deduct one-half of the self-employment tax.

However when you are filling out your 1040 the IRS allows you to deduct a portion of the self-employment tax. What is my tax-equivalent yield. SE tax deduction.

Its actually one of the most common self-employment tax deductions. When you work for someone else youre only responsible for part of these taxes while your employer pays the balance. Generally it applies to self-employment earnings of 400 or more.

To file yearly taxes youll need a Schedule Cform. Using these same figures to calculate the Standard Mileage deduction the driver multiplies the business mileage 5000 miles by the standard mileage rate 56 cents per mile in 2021 for a Standard Mileage deduction of 2800. As with Social Security use your gross pay your pay before any taxes are taken out for this calculation.

Filing an annual return. To figure out what your skills are worth start by finding out what others in the same. A 100 deduction is allowed for certain business meals paid or incurred after 2020 and before 2023.

Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. Medicare tax rate for 2019 is 145 for the employee portion and 145 for the employer portion. Self-employment is the state of working for oneself rather than an employer.

A 100 deduction is allowed for certain business meals paid or incurred after 2020 and before 2023. Deduction for Self-Employment Tax. 2022 to July 2022 there was an average of 91 to 92 million Americans that were self-employed.

There is no W-2 self-employed specific form that you can create. 115-97 Tax Cuts and Jobs Act changed the rules for the deduction of food or beverage expenses that are excludable from employee income as a de minimis fringe benefit. Although the self-employment tax rules contain a provision that overrides community income treatment in the case of spouses section 1402a5 of the Internal Revenue Code this provision does not apply to RDPs.

Self-employed individuals generally must pay self-employment SE tax as well as income tax. You must pay self-employment tax and file Schedule SE Form 1040 or 1040-SR if either of the following applies. You calculate this deduction on Schedule SE attach Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF.

You calculate the home office deduction first on Form 8829. IRS Publication 587. This too is a flat tax rate.

For example a 1000 self-employment tax payment reduces taxable. Deductions To Reduce Self Employment Taxes. 2022 tax refund.

For the 2021 tax year payable on April 18 of 2022 the rate stood at 153. Whether youre self-employed or an employee youll have to pay Social Security and Medicare taxes to the government. This final number is the self-employment tax you owe.

Capital gains losses tax estimator.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Calculator For Self Employed Discount 59 Off Www Ingeniovirtual Com

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Calculate Self Employment Tax In The U S With Pictures

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Calculate Self Employment Tax In The U S With Pictures

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Self Employed Health Insurance Deduction Healthinsurance Org

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

Schedule C Income Mortgagemark Com

A Guide To Taxes For The Self Employed And Independent Contractors

Llc Tax Calculator Definitive Small Business Tax Estimator

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps